As college tuition continues to skyrocket, it's becoming more important than ever to know how the various savings plans work. This handy reference outlines the latest rules on the most popular college savings programs, and how to use them to save money on your children's education.

Aside from retirement, saving for a child’s college education is one of the biggest expenses a family encounters. And with college savings vehicles multiplying all the time and tax laws changing, the landscape of college education funding rules can be downright bewildering.

In deciding how much to contribute to college savings accounts, when to contribute, and where to invest those contributions, you’ll need to remain aware of all your options and their accompanying rules. Hence, this handy guide.

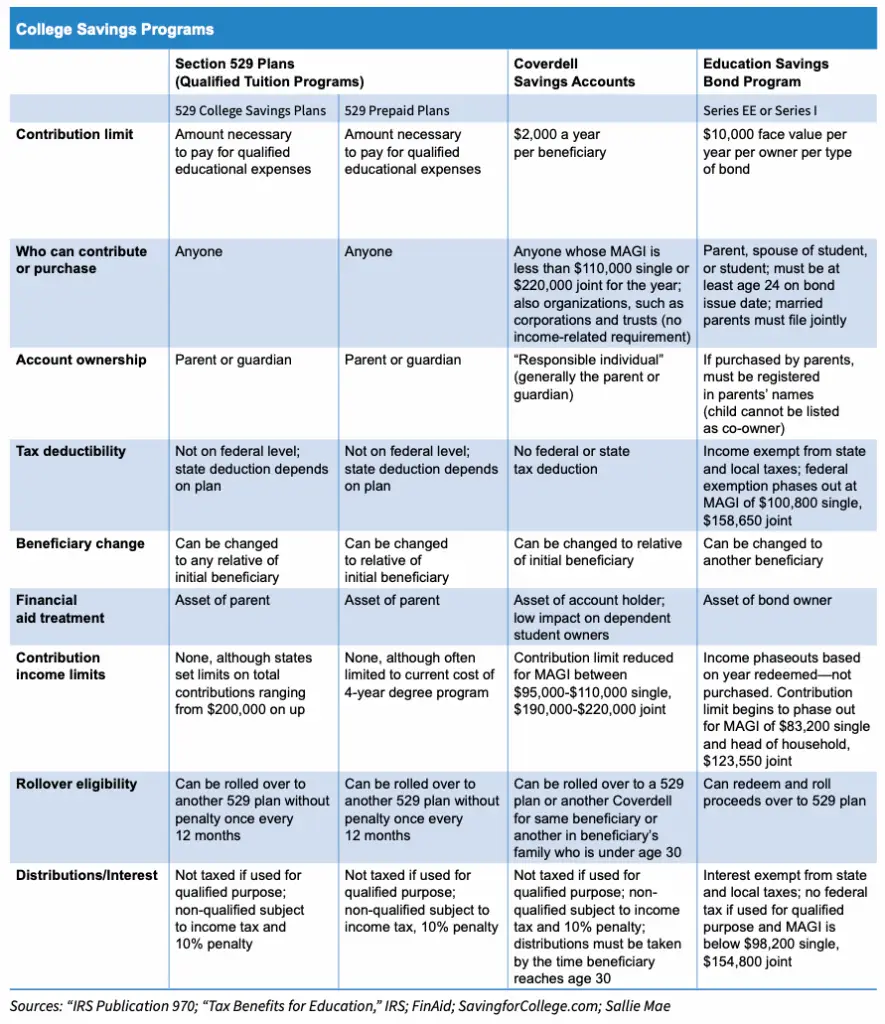

COLLEGE SAVINGS PLANS

The biggest college savings plans are the Qualified Tuition Programs (QTPs) or Section 529 plans, education savings accounts (ESAs) or Coverdell savings accounts, and the Education Savings Bond program.

As the cost of college continues to climb, these college savings vehicles keep gathering assets. The College Savings Plan Network reported that 529 saving plan assets reached $328.9 billion in 2018. Fiscal Cliff legislation enacted in 2013 permanently extended what were previous temporary enhancements to Coverdell savings accounts. Parents and grandparents can continue to contribute up to $2,000 a year to a Coverdell account and use those funds for kindergarten through 12th grade expenses.

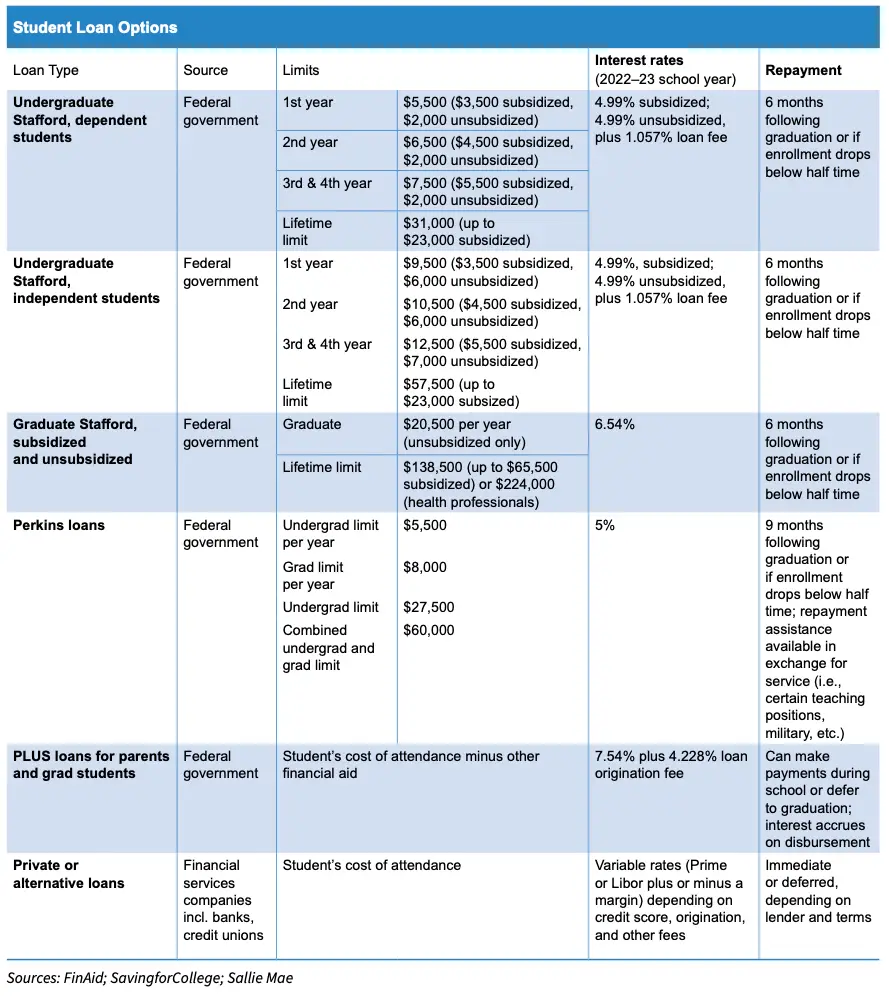

STUDENT LOAN AVAILABILITY AND LIMITS

For many children of high-net-worth families, much of a financial aid package from colleges comes in the form of student loans. These loans take a variety of forms and have limits on how much a student or parent can borrow, the interest rates charged, and repayment terms.

An important distinction with student loans is whether they are “subsidized” or not. Interest on unsubsidized loans starts accruing when the loan is disbursed, although no payments are required while the student is enrolled in school at least half time (unpaid interest is capitalized at the end of the grace period). Interest on subsidized loans does not accrue while the student is enrolled at least half time.

Monthly interest that accrues on a student loan can be calculated with a daily interest formula. Current loan balance x number of days since last payment x interest rate factor, which you determine by dividing the loan’s interest rate by the number of days in the year.

For example, an undergraduate student has a $5,500 Stafford subsidized loan balance at a 4.99% interest rate and now plans to make his third payment. He calculates $5,500 x 25 (days since last payment) x 0.014% (interest rate factor) = $19.25 (interest owed since last payment).

Unlike undergraduates, graduate students are not eligible for new subsidized loans after July 1, 2012. But they may continue to use the subsidized loans they received prior to this date. The graduate student’s $65,500 cumulative subsidized loan limit takes into account pre-2012 subsidized loans for graduate and undergraduate coursework.

With subsidized and unsubsidized loans, payments must start six months after graduation (nine months for Perkins loans) or after dropping to less than half-time status.

In 2013, Congress agreed to market-based rates for loans. Student loans are now tied to the 10-year treasury note which means interest rates are likely in increase.

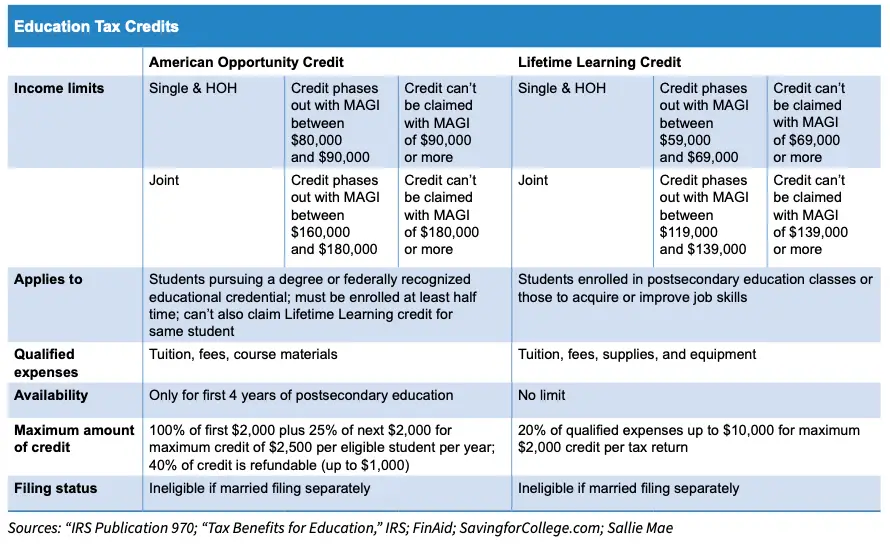

EDUCATION TAX CREDITS

Fiscal cliff legislation extended the American Opportunity Tax Credit for 2021 tax returns and beyond. Eligible taxpayers can claim only one of these credits in a given tax year for a single student. However, if a taxpayer claims two eligible students on a return, one credit can be claimed for each student.

Credits can be selected on a per-student, per-year basis, which means taxpayers can switch between the American Opportunity Credit and the Lifetime Learning Credit for their children in different tax years, if they desire to do so.

STUDENT LOAN INTEREST DEDUCTION

Eligible taxpayers are permitted to deduct a certain amount of student loan interest. You may take this deduction if the interest is eligible—that is, from a qualified educational institution and the purpose was education—and if your modified adjusted gross income is less than $85,000 (phaseout between $70,000 and $85,000) for a single taxpayer and $170,000 (phaseout between $145,000 and $175,000) for married filing jointly.

The maximum deduction is $2,500 and claimed directly from gross income. The student must be the taxpayer, the taxpayer’s spouse, or a dependent enrolled at least half time in a degree program. Qualified educational expenses include tuition, room and board, books, supplies, equipment, and other necessary expenses.

Amy E. Buttell is a freelance journalist who lives and works in Erie, Pa. She’s been published in the Journal of Financial Planning, the Financial Planning Association’s Practice Management Solutions Journal, the New York Society of Security Analysts’ journal, and The Investment Professional.

Copyright @ 2025 by Horsesmouth, LLC. All rights reserved.

License # 6098580, Reprint Licensee: Michael Korch.